Click the Image Below to Start Using the All in One Mortgage Loan Simulator

*If you have not spoken to Derek yet in regards to this loan for you and your situation, please do so before running the simulator. Derek can also do the simulator with you at an appointed time to make sure it is done correctly and we get correct results for you... either good or bad. This loan isn't for everybody, but for the borrowers who qualify, it can truly be amazing.

In just 4 easy steps, the Interactive Simulator will calculate how a borrower's cash-flow habits impacts their daily All In One loan principal and monthly loan interest costs. Get your results NOW!

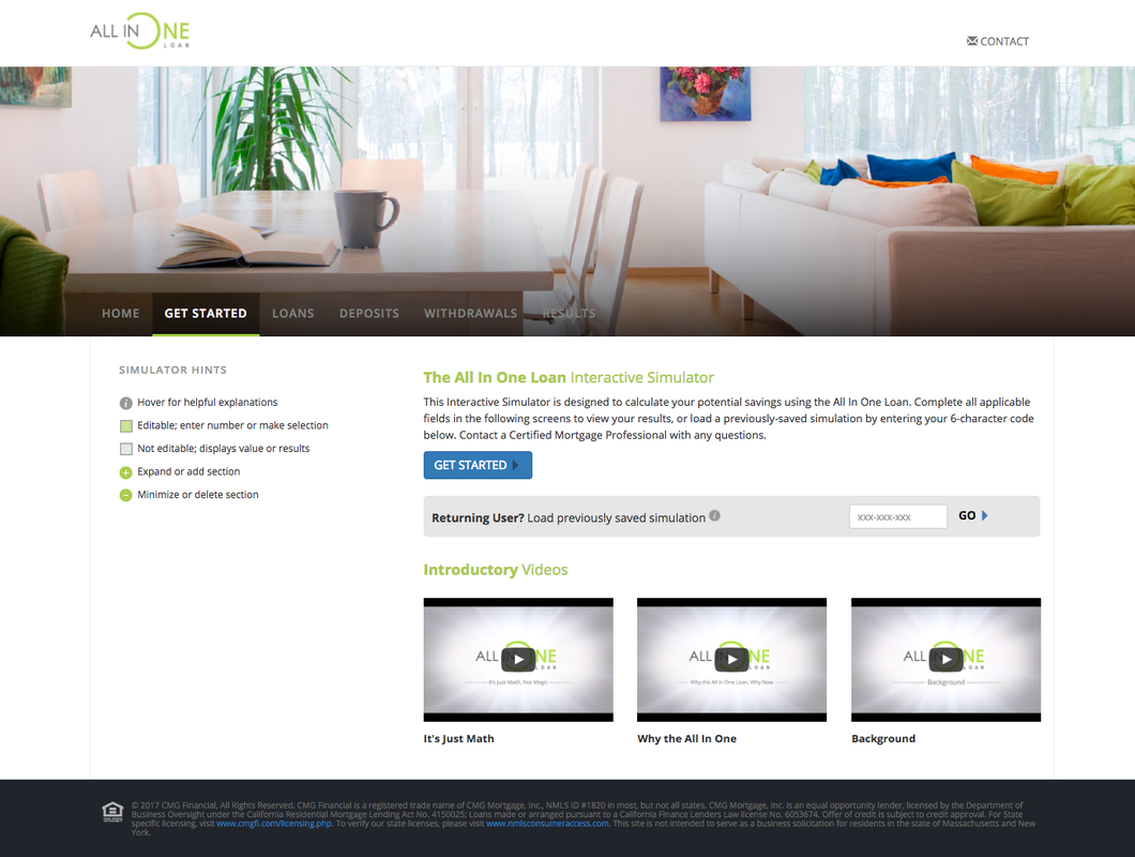

GETTING STARTED

This page provides helpful tips and videos describing not only how the Interactive Simulator works but also how the All In One works, including its history, why it's the perfect time to consider all-in-one financing and the math that powers its benefits. Returning customers can also enter a key-code in this screen to call up a previously saved simulation from up to 30 days ago.

This page provides helpful tips and videos describing not only how the Interactive Simulator works but also how the All In One works, including its history, why it's the perfect time to consider all-in-one financing and the math that powers its benefits. Returning customers can also enter a key-code in this screen to call up a previously saved simulation from up to 30 days ago.

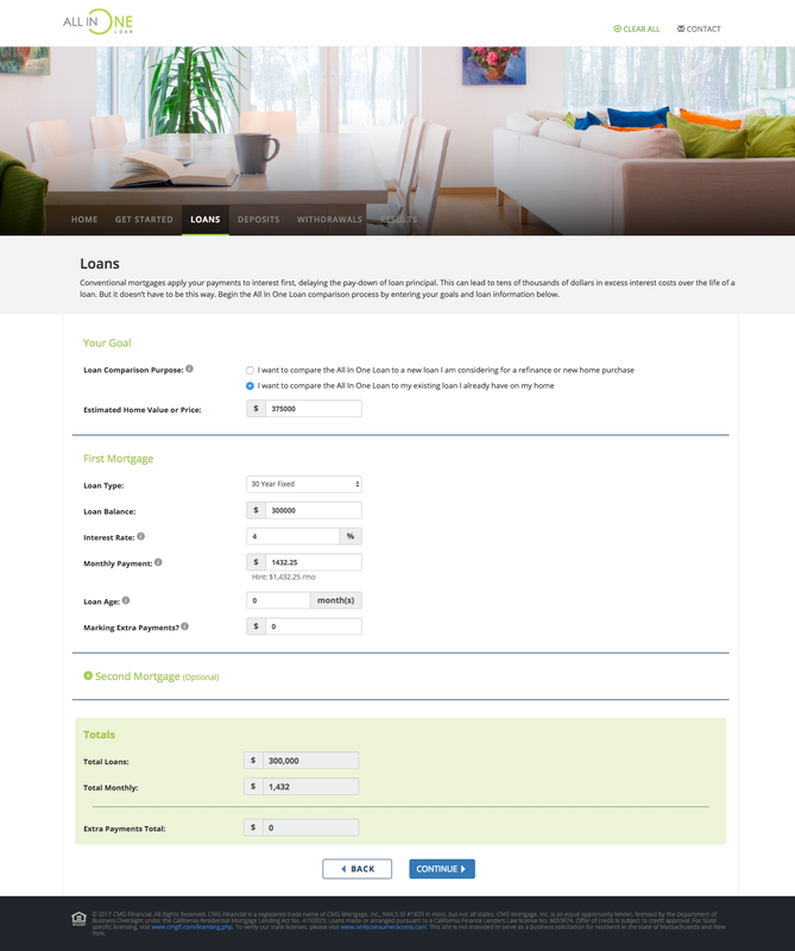

LOANS

This page provides the opportunity for clients to input their financing goals as well as the amount owned on their current mortgages. Extra payments being made can also be accounted for here.

Keep in mind, one of the biggest reasons the All In One Loan lowers principal so rapidly, is because budgeted payments on current or potential conventional mortgages will not have to be made once a borrower finances with the All In One Loan. Those dollars will remain in the account, as they normally would a checking account, keeping the balance in which interest is calculated, lower.

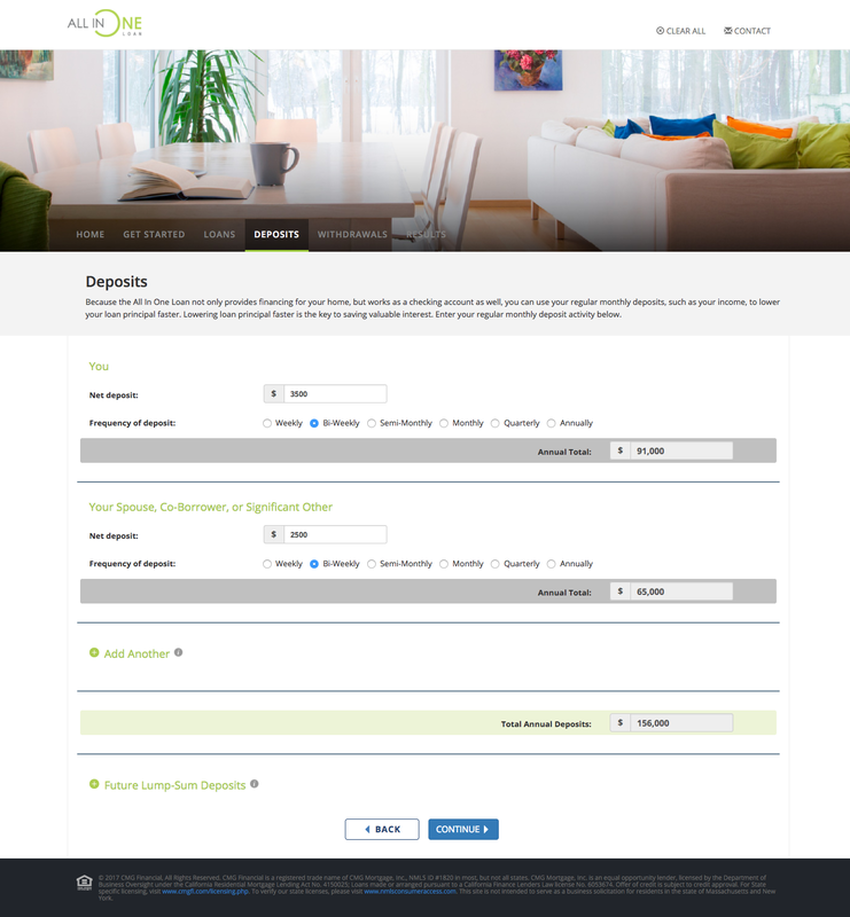

DEPOSITS

On this page, clients can account for their ongoing deposits, whether their regular paychecks, small business cash-flow, or future lump-sum amounts, all of it helps drive down their All In One Loan balance faster.

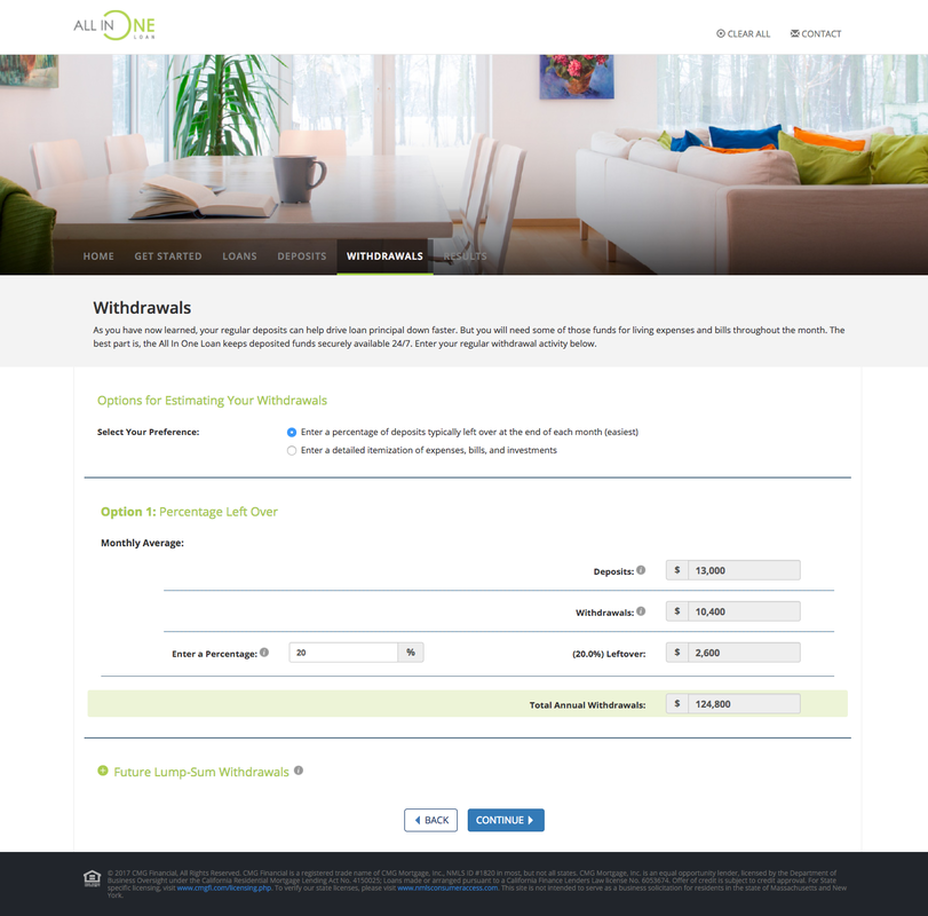

WITHDRAWALS

As deposits lower the loans balance in which interest is calculated, withdrawals from the All In One Loan account increase it. On this page, account for all withdrawals spent towards regular and future expenses.

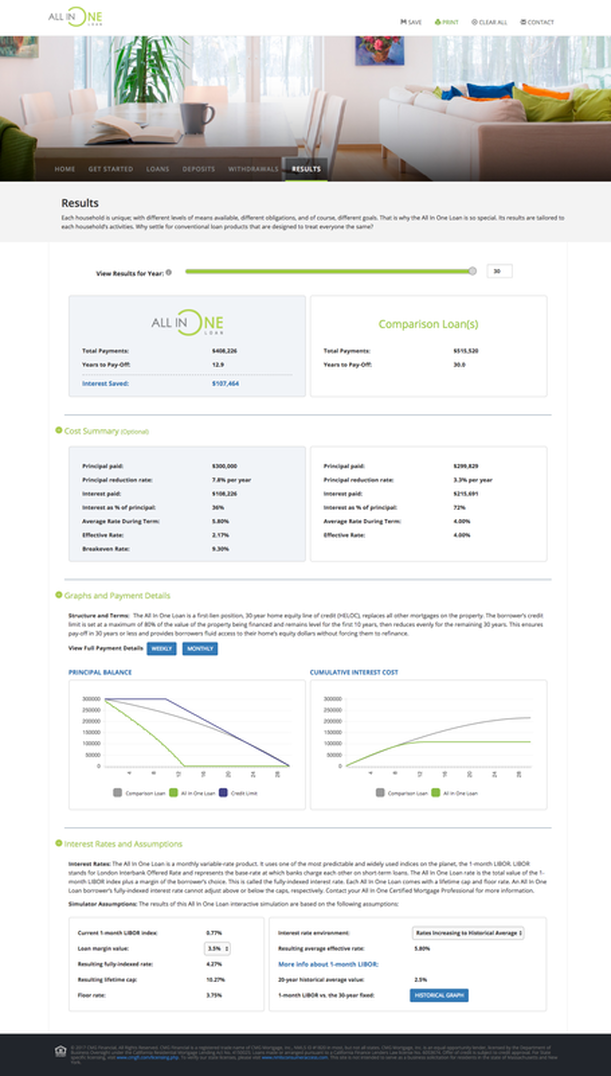

RESULTS

Within minutes a borrower can see the results of their inputs and analyze whether or not the All In One Loan is right for them. The results page breaks down their potential interest and payoff savings, compared to a conventional mortgage, as well as their home's equity growth during upward and downward swings in the housing market.

Graphs and Payment Details

Many borrowers are used to using a regular mortgage calculator to view anticipated monthly payment amounts and loan principal reduction, broken out in an excel-style format. This page allows them to view the estimated results of the All In One Loan in the same manner.

Interest Rate and Assumptions

After reviewing their results, a borrower can review the interest rate assumptions driving those numbers. The All In One Loan is based on the 1-month LIBOR index plus a margin, displayed on this screen. The lifetime rate-cap and floor are also described. This screen also provides the borrower the ability to enter in future anticipated lump-sum deposits and withdrawals and recalculate the results.

Save or Print Results

The Interactive Simulator allows potential borrowers to conveniently save and access their results for 30 days without having to enter any personal information at all.